Insights into Homebuying Trends: Unpacking the 2023 Market and Gazing into 2024

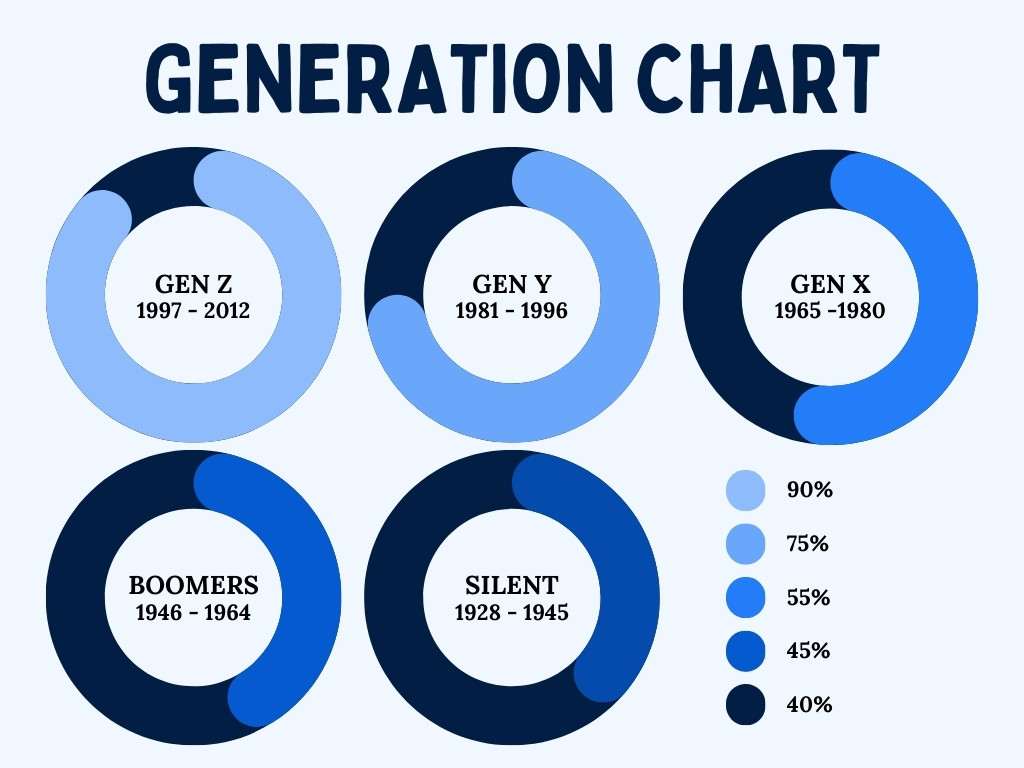

In 2023, the homeownership rate for adult Gen Zers (19-26 years old) remained stagnant due to challenging conditions in the housing market, including high mortgage rates exceeding 8% and elevated housing prices. This made it particularly tough for the youngest homebuyers who were just starting their careers and lacked significant savings. However, the outlook for 2024 is more promising, with mortgage rates dropping to 6.8%, resulting in a $300 reduction in monthly payments from the 2022 peak. This decline has stimulated both buyers and sellers, leading to an increase in new listings and providing buyers with more choices, potentially easing the upward pressure on prices.

Optimal Age Demographics:

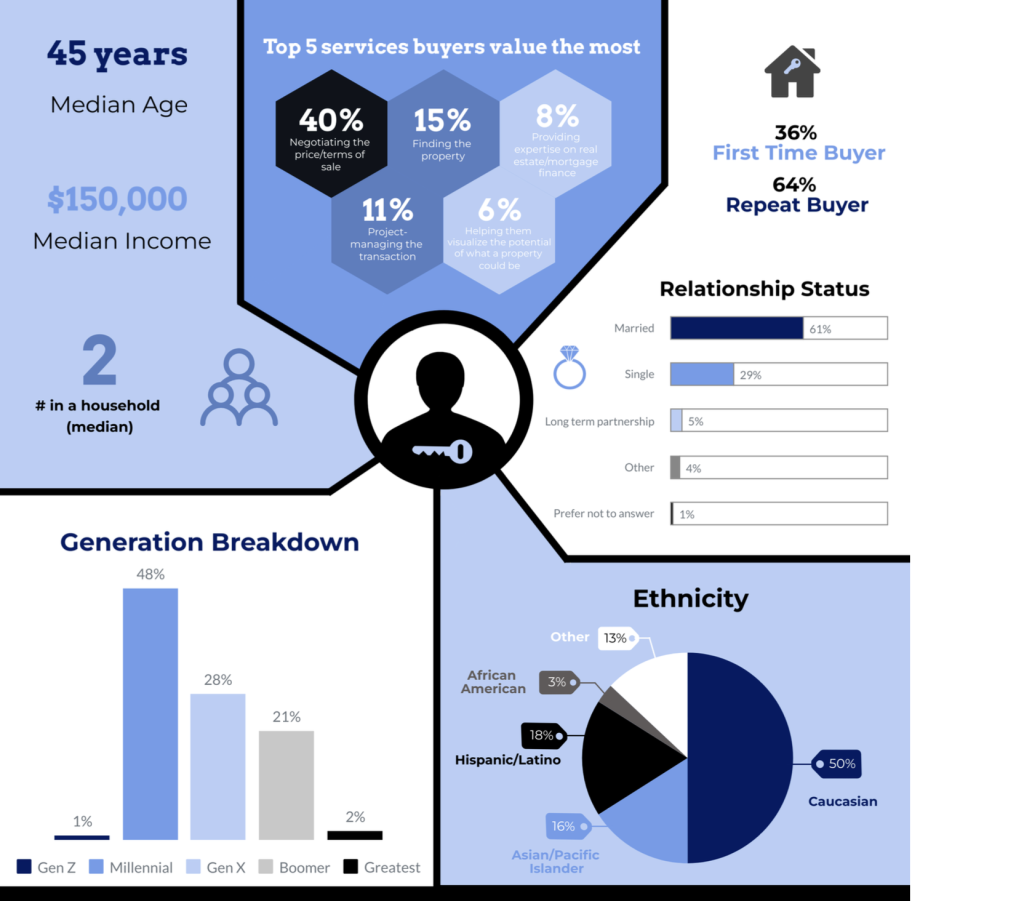

- The median age of homebuyers in 2023 stood at approximately 45 years old, strategically positioning them in the intersection between older millennials and Gen X. This age bracket emerged as a significant force, embodying a dynamic mix of experience and modern preferences in home selection.

Financial Challenges in Prime Locations:

- With a median income of $150,000, homebuyers faced the financial hurdles of acquiring properties in notoriously high-cost areas such as the Bay Area. This sheds light on the resilience and determination of buyers seeking homeownership in regions known for their premium real estate markets.

Married Couples as Market Leaders in 2023:

- Married couples emerged as the driving force in the 2023 real estate market, leveraging the advantages of pooling financial resources and capitalizing on tax benefits. This trend underscores the collaborative approach of couples embarking on the journey of homeownership.

- First-Time Buyers and Down Payment Assistance Programs:

- A noteworthy revelation was that approximately one-third of homebuyers were first-time buyers. This surge can be attributed to the effectiveness of the state’s robust down payment assistance programs. These initiatives have played a pivotal role in facilitating entry into the housing market, making the dream of homeownership a reality for many.

The Enigma of 2024: Anticipating Interest Rate Dynamics:

- The blog post concludes by addressing the real estate speaker’s curiosity about the potential impact of rumored interest rate decreases in 2024. This speculation raises questions about whether the market will experience heightened activity or a possible slowdown. Real estate agents are left to ponder the implications of this uncertainty and strategize accordingly in the coming year.

In summary, understanding these nuanced facets of the 2023 real estate market equips agents with valuable insights, enabling them to adapt their strategies to the evolving needs and dynamics of prospective homebuyers. In 2024, the anticipation surrounding interest rate fluctuations adds an extra layer of complexity, requiring vigilance and strategic planning from industry professionals.

Post Links:

http://RealtorHarvinder.com/2023buyers

https://bit.ly/2023BuyerSnapshot

Link for this post:

https://Harvinder.dscloud.me/blog/03/02/2024/2023-homebuying/

Related Posts

Gilroy, CA – Power Surge: Seizing Opportunities in a Competitive Real Estate Market 2024

35536 Provance Street, Newark: A Move-In-Ready Gem in the Heart of the Bay Area

Stunning Renovation: Open House 37036 Blacow, Fremont

About The Author

Harvinder Balu

Harvinder Balu | CA DRE 02195792 | 510-600-3425 | info@RealtorHarvinder.com | http://www.RealtorHarvinder.com