Why Pre-Approval is Crucial in the Home Buying Process

Pre-Approved Buying a home

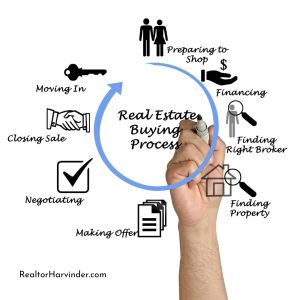

is one of the most significant decisions in life, and it can often feel overwhelming. Whether you’re a first-time homebuyer or a seasoned investor, navigating the home-buying process requires careful planning and strategy. One of the most critical steps in this journey is obtaining a mortgage pre-approval. Yet, many buyers overlook or underestimate its importance, which can lead to missed opportunities or unnecessary stress.

In this blog, we’ll dive deep into why pre-approval is a game-changer in the real estate market, how it benefits buyers and sellers alike, and tips to get started with the process.

What is a Mortgage Pre-Approval?

A pre-approval is an evaluation by a lender that determines how much they are willing to lend you for a home purchase. It’s based on a detailed review of your financial situation, including your income, credit history, assets, and debt. Once approved, you’ll receive a pre-approval letter stating the loan amount you qualify for. This letter is usually valid for 30 to 90 days.

It’s important to note that a pre-approval is not a guarantee of a loan but a conditional assessment of your borrowing capacity.

The Benefits of Getting Pre-Approved

- Helps Define Your Budget

Understanding how much home you can afford is the first step to finding your dream property. Pre-approval provides a clear budget, ensuring you only look at homes within your financial reach. This saves time and avoids heartbreak over properties that might be out of your price range.

Makes You a Serious Buyer

In a competitive market like Fremont, where homes can sell quickly, having a pre-approval letter shows sellers that you’re a serious and qualified buyer. This can make your offer stand out, especially in multiple-offer situations. Sellers are more likely to negotiate or prioritize offers backed by pre-approved buyers.

Speeds Up the Buying Process

Since your financial documents have already been reviewed during pre-approval, the loan underwriting process becomes faster once you’ve made an offer. This efficiency is especially beneficial in a fast-paced market where time is of the essence.

Protects You from Rising Interest Rates

In some cases, pre-approval allows you to lock in an interest rate for a set period. This protection can save you from unexpected increases in rates, giving you peace of mind as you search for a home.

How to Get Pre-Approved

Getting pre-approved involves gathering the necessary financial documents and choosing the right lender. Here’s a quick checklist to help you get started:

- Proof of income (pay stubs, W-2s, or tax returns)

- Bank statements and proof of assets

- Credit history and credit score

- Details of any outstanding debts or loans

Once you’ve submitted the required information, the lender will evaluate your financial situation and provide a pre-approval letter. Working with a trusted mortgage lender can make this process smooth and stress-free.

Why Pre-Approval Matters in Fremont’s Real Estate Market

As a real estate agent in Fremont, I’ve seen firsthand how pre-approval can make or break a deal. The Bay Area housing market is competitive, with high demand and limited inventory. Buyers who are pre-approved are better positioned to act quickly and confidently when the right home comes along.

For sellers, a pre-approved buyer provides reassurance that the transaction is less likely to face delays or fall through due to financing issues. This is why I always recommend my clients get pre-approved before starting their home search.

Common Myths About Pre-Approval

“I don’t need pre-approval until I find a home.”

Wrong! Pre-approval should be your first step, as it helps streamline your search and strengthens your offers.“Pre-approval guarantees a loan.”

While pre-approval is a strong indicator, final loan approval depends on various factors, including a property appraisal and your financial stability at the time of purchase.“Pre-approval impacts my credit score significantly.”

The impact is minimal, and the benefits far outweigh the temporary dip in your score.

Final Thoughts

Pre-approval is not just a financial formality—it’s a strategic move that empowers you as a buyer. It provides clarity, builds trust with sellers, and speeds up the overall process. For sellers, it signals a serious buyer who is ready to close the deal.

If you’re considering buying a home in Fremont or the Bay Area, I’m here to guide you every step of the way. From pre-approval to closing, my goal is to make the process smooth, transparent, and stress-free.

Ready to take the first step? Let’s connect today and start your journey to finding the perfect home.

Contact me today for expert real estate advice and services. Let’s make your home-buying dreams a reality!

Links and Resources:

Alameda County : Latest Inventory & Market Update: https://Harvinder.dscloud.me/blog/reports-by-cities/alameda-county/

Direct Link for this post: https://Harvinder.dscloud.me/blog/11/17/2024/pre-approval-home-buying/

Disclaimer: This article is for general informational and educational purposes only. It is not intended to provide legal advice, tax advice, financial advice, or professional guidance of any kind. Readers should not rely solely on the information presented here when making decisions. Laws and regulations may change and individual situations vary. Always consult with a qualified attorney, tax professional, or financial advisor before taking any action related to the topics discussed.

Related Posts

Hayward, CA Real Estate Market Report: December 2024 Insights for Buyers and Sellers

Essential November Home Maintenance Tips for Bay Area Homeowners

Gilroy, CA – Power Surge: Seizing Opportunities in a Competitive Real Estate Market 2024

About The Author

Harv

HarvRealtor.com | Harv Balu, CIPS, GRI, FTBS, PSA | Tech-savvy Realtor & proud father of 3, committed to seamless real estate journeys. With 15+yrs in IT & passion for real estate, I offer tailored services. Enthusiast photographer, green-thumbed gardener.